Individual insurance premiums for less than a month. Fixed payment calculator for individual entrepreneurs

The individual entrepreneur insurance premium calculator helps calculate mandatory individual entrepreneur insurance premiums for 2017 -2019. To calculate contributions, select the desired year and indicate the income received if it is more than 300 thousand rubles.

Subscribe to our Telegram channel so you don't miss important news for entrepreneurs.

Who pays insurance premiums

All entrepreneurs pay a fixed portion of insurance premiums to the Pension Fund and the Federal Compulsory Medical Insurance Fund, even in the absence of activity.

If your income for the year exceeds 300 thousand rubles, then an additional 1% of the excess amount is paid to the Pension Fund.

How to calculate income

To pay an additional 1% to the Pension Fund, the amount of income is calculated as follows:

- for the simplified tax system - this is all income, excluding expenses ( line 113 of section 2.1.1 of the declaration under the simplified tax system income and line 213 of section 2.2 of the declaration under the simplified tax system income minus expenses),

- for UTII - this is imputed income for the year ( the sum of the values on line 100 of section 2 of the UTII declarations for all quarters),

- for the patent system, this is the potential annual income ( line 010). If the patent was received for a period of less than 12 months, then the annual income must be divided by 12 and multiplied by the number of months of the period for which the patent was issued ( line 020).

If an entrepreneur combines several tax regimes, then the income from each of them is summed up.

Deadline for payment of insurance premiums

The fixed part of the insurance premiums must be paid before December 31. Additional 1% in the Pension Fund - until July 1 of the next year.

Insurance premiums for less than a year

If you have not been registered as an individual entrepreneur since the beginning of the year, then in the field beginning of period indicate the date of registration as an individual entrepreneur.

If you have ceased activities as an individual entrepreneur, then in the field end of period indicate the date of termination of activity as an individual entrepreneur.

Individuals who are registered as individual entrepreneurs are required to independently calculate and pay insurance premiums. At the same time, the translation Money should be carried out even if the individual entrepreneur does not conduct business activities and does not receive income for some period. The tax regime is also unimportant.

Payment of insurance premiums is made by individual entrepreneurs to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund, but according to the details of your Federal Tax Service. An individual entrepreneur does not pay anything to the Social Insurance Fund. Because of this, individual entrepreneurs cannot reimburse sick leave. Insurance premiums are considered and paid by an individual entrepreneur in accordance with Chapter 34 of the Tax Code of the Russian Federation.

The amount of insurance premiums is calculated based on the income (not profit!) of the individual entrepreneur. Sometimes an individual entrepreneur combines several taxation systems. To calculate contributions, income from them is added up.

What contributions does an individual entrepreneur pay under the simplified tax system and other modes?

Very detailed information about the calculation of insurance premiums based on the minimum wage. Therefore, I will not repeat myself here and will give ready-made figures that are obtained for the year. The minimum contribution amount (this is fixed part) in 2017 is 27,990 rubles, incl.

- to the Pension Fund of Russia - 23,400 rubles,

- in FFOMS - 4590 rubles.

This amount is transferred to the budget if the individual entrepreneur’s income for the calendar year was less than 300,000 rubles. or absent altogether.

If in a calendar year an individual entrepreneur received more than 300,000 rubles. income, then in addition to mandatory contributions in the amount of 27,990 rubles. he is obliged to transfer to the budget contributions in the amount of 1% of income, beyond 300,000 rubles.

In 2017, individual entrepreneurs are required to pay insurance premiums within the following terms:

- the fixed part (RUB 27,990) must be transferred before December 31, 2017 (I highly recommend paying early, at least before December 25, otherwise the payment will not arrive in time!).

- the amount of contributions is 1% from excess income of 300,000 rubles. must be paid until April 1, 2018.

Also be sure to read how paid it will serve you well.

How to calculate individual entrepreneur contributions for an incomplete year

Newly created individual entrepreneurs must pay fees for less than a year(after all, registering with the tax office on January 1 is almost impossible). Let's figure out how to calculate the fixed part of contributions in this case.

Individual entrepreneur contributions for less than a year decrease in proportion to calendar months and days from the moment of registration of the individual entrepreneur.

According to paragraph 3 of Art. 430 of the Tax Code, individual entrepreneurs who were not registered from the beginning of the calendar year must reduce the amount of insurance premiums for the year in proportion to the number of months, starting from the calendar month in which the individual entrepreneur was registered. In the first month of registration, contributions are calculated in proportion to the number of calendar days in a given month.

The month in which an individual registered with the tax authorities as an individual entrepreneur is considered the calendar month of commencement of activity.

Minimum wage x Tariff x M + minimum wage x Tariff x D/P,

M - the number of full months in the reporting year when the individual entrepreneur was already registered,

D - the number of days in the month in which the individual entrepreneur was registered. The number of days is counted from the date of registration (it is turned on) until the end of the month,

P - the number of calendar days in the month of registration of an individual entrepreneur.

Should the registration day be taken into account for individual entrepreneur contributions for an incomplete year?

Is the day of registration included in the data for calculating insurance premiums for a partial month? There is no consensus on this issue.

The Ministry of Labor, in letter dated 04/01/2014 No. 17-4/OOG-224, expressed its position that it is not necessary to take into account the day of registration. True, these clarifications were given for insurance premiums that were paid before 2017 in accordance with Law No. 212-FZ (but the calculation rules were similar). This is what the ministry's conclusions are based on:

An individual acquires the status of an individual entrepreneur on the day of registration and inclusion in the Unified State Register of Individual Entrepreneurs. Part 2 art. 4 212-FZ states that the period begins to run from the next calendar day after the commission of an action or the occurrence of an event.

In practice, the Pension Fund also took into account the day of registration. In addition, the Federal Tax Service is currently the administrator of insurance premiums, so it is difficult to say what will happen with this issue.

Therefore it is safer include the day of registration in the calculation of contributions IP for less than a year. The overpayment will be small (only a few tens of rubles), but you will not have to argue with the Federal Tax Service. If your tax office considers that you must pay contributions from the day following the day of registration, you will receive a small overpayment, which you can later offset as payment for other years.

We calculate individual entrepreneur contributions for an incomplete year using an example

Let's see how individual entrepreneur contributions for less than a full year will be calculated. practical example. IP Ivanov P.S. registered on May 26, 2017 (this date is written in the individual entrepreneur’s registration certificate). The minimum wage as of January 1, 2017 is 7,500 rubles. Let's calculate the amount of insurance premiums for 2017.

IP Ivanov P.S. will be registered in 2017 for 7 full months (June to December). There are 31 calendar days in May. Of these, the individual entrepreneur was registered from May 26 to May 31, i.e. 6 days.

The fixed payment for 2014 will be:

to the Pension Fund of Russia:

- for 7 full months: 7500 x 26% x 7 months = 13650 rub.,

- for May: 7500 x 26% x 6/31 = 377.42 rubles.

Total for 2017: 13650 + 377.42 = 14027.42 rubles.

where 31 is the number of days in March, 6 is the number of days the entrepreneur was registered as an individual entrepreneur in May, counting the day of registration.

in FFOMS:

- for 7 full months: 7500 x 5.1% x 7 months. =2677.50 rub.

- for May: 7500 x 5.1% x 6 / 31 = 74.03 rubles.

Total for 2017: RUB 2,677.50. + 74.03 rub. = 2751.53 rub.

If the individual entrepreneur officially ceased its activities during the calendar year, then the individual entrepreneur’s contributions for an incomplete year are calculated in the same way, only the incomplete month will be the last, i.e. month of closure of the IP.

At the same time, the calculation of individual entrepreneur contributions from income that exceeded 300,000 rubles in a calendar year in the amount of 1% is carried out in the same way, regardless of whether the individual entrepreneur was registered during a full or incomplete calendar year.

If you need to calculate insurance premiums for individual entrepreneurs using the simplified tax system for your situation or need advice on how to competently reduce the single tax on insurance premiums, write to me on the page. Find out how I can help Internet entrepreneurs, take a look at the page.

Insurance premiums for individual entrepreneurs in 2017

From the moment they receive their status, individual entrepreneurs are required to make contributions to their own pension and health insurance. This is the only category of citizens in Russia that does this independently.

For all hired employees, contributions to extra-budgetary funds are made by the employer. This amount is not withheld from the employee’s salary (like personal income tax 13%), but is paid from the company’s own funds in addition to the salary.

An individual entrepreneur is not an employee; he does not pay himself a salary. His income is the profit received from business activities. It is not the basis for calculating the amount of contributions to the Pension Fund. Therefore, a special accrual procedure applies to entrepreneurs.

An individual entrepreneur is not an employee; he does not pay himself a salary. His income is the profit received from business activities. It is not the basis for calculating the amount of contributions to the Pension Fund. Therefore, a special accrual procedure applies to entrepreneurs.

Since 2014, contributions to the Pension Fund have consisted of two parts: fixed and paid on income over 300,000 rubles.

Regarding the fixed part of insurance premiums, 2 most important rules apply:

- They begin to accrue from the moment of registration of the individual entrepreneur.

- They must be paid to all entrepreneurs without exception, regardless of whether they were active or not. Many individual entrepreneurs mistakenly believe that since they did not manage to receive their first profit, they are not required to pay contributions. In fact, the lack of income or losses incurred do not relieve one from the obligation to make contributions to extra-budgetary funds.

The basis for calculating fixed pension taxes for entrepreneurs is the minimum wage for the current year. In this case, we are talking about the federal minimum wage, which is the same for all Russian regions. Every year the government indexes the minimum wage, which leads to an increase in the amount of contributions to the Pension Fund.

The tariff for paying pension payments for individual entrepreneurs is 26% in the Pension Fund and 5.1% in the Compulsory Medical Insurance Fund. If the Compulsory Medical Insurance Fund establishes a single tariff for workers and the self-employed population, then in the Pension Fund it is higher for individual entrepreneurs than for hired employees (for them contributions are charged at a rate of 22%). Pension contributions are no longer divided into funded and insurance parts, as there is a moratorium on the funded component.

For the entire 2016, entrepreneurs must pay 23,153.33 rubles. (of which 3,796.85 rubles go to the Compulsory Medical Insurance Fund, and the rest to the Pension Fund) and another 1% from income over 300 thousand rubles. As a result, each individual entrepreneur will pay his own amount of contributions, which will directly depend on the success of his entrepreneurial activity. Additional contributions are transferred only to Pension Fund.

For the entire 2016, entrepreneurs must pay 23,153.33 rubles. (of which 3,796.85 rubles go to the Compulsory Medical Insurance Fund, and the rest to the Pension Fund) and another 1% from income over 300 thousand rubles. As a result, each individual entrepreneur will pay his own amount of contributions, which will directly depend on the success of his entrepreneurial activity. Additional contributions are transferred only to Pension Fund.

For example, an individual entrepreneur earned 1.5 million rubles in 2016. He must transfer 23,153.33 rubles to the Pension Fund. and 12,000 rub. additionally from excess income (1,500,000-300,000) * 1%)).

It is worth understanding that income is the entire profit of the entrepreneur for the year without reduction for expenses incurred. This is true for simplified taxation system-income, simplified taxation system-income-expenses and OSNO. For “imputation” and “patent”, possible, or imputed, income is included in the calculation.

If an entrepreneur combines several taxation systems, then the income received under each of them must be added up.

Legislators also provided a limit on insurance premiums, more than which individual entrepreneurs will not pay in any case. In 2016 it is 158,648.69 rubles. The specified maximum value of deductions will have to be paid by businessmen who do not submit a tax return within the established time frame. Therefore, it is important to report to the Federal Tax Service on time.

Entrepreneurs need to pay a fixed part of taxes by December 31, 2016; for the additional part, the deadline is set at April 1, 2017.

Return to contents

Insurance premiums for less than a year

The procedure for calculating insurance premiums for individual entrepreneurs for less than a full year is relevant for the following categories of businessmen:

The procedure for calculating insurance premiums for individual entrepreneurs for less than a full year is relevant for the following categories of businessmen:

- those who opened their own business not from the beginning of the year;

- having a temporary exemption from paying contributions (for the period of parental leave, military service, for the period of caring for a disabled child, etc.);

- when closing an individual entrepreneur in the middle of the year.

In the above situations, payments are calculated in proportion to the number of days (months) during which business activity was carried out.

The calculation of insurance premiums for individual entrepreneurs for an incomplete year can be divided into 2 stages:

- For fully worked calendar months, the calculation is carried out using the formula: minimum wage * 26% (or 5.1% for FFOMS) * number of full months.

- For incomplete months, you need to divide the number of days worked by the total number of days in the month and multiply this value by the tariff and the minimum wage.

In 2016, the minimum wage is 6,204 rubles. Despite the fact that since July 2016 the minimum wage was indexed to 7,500 rubles, pension contributions are calculated according to the value in effect at the beginning of the year: 6,204 rubles.

Based on the indicated value, every month the entrepreneur must transfer 1613.04 (6204 * 26%) to the Pension Fund and 316.40 rubles. (6204*5.1%) in the FFOMS.

Let us give an example of calculating insurance premiums for individual entrepreneurs for less than a full year. For example, citizen Ivanov received the status of an entrepreneur on March 12, 2016. The number of fully worked months is 9. During this period, Ivanov will have to transfer 14,517.36 rubles. (9*6024*26%) to the Pension Fund and 2747.36 rubles. (9*6204*5.1%) in the Compulsory Medical Insurance Fund. The payment calculation for March will be as follows: 6204*19/31*26%+6204*19/31*5.1%. This means that the amount payable for March will be 988.64 + 193.93 = 1182.57 rubles.

Additional deductions do not depend on the number of months worked by the individual entrepreneur, but only on the amount of revenue received.

It is worth noting that the Pension Fund usually sends ready-made payment slips to entrepreneurs with the amount to be paid indicated on them. Some Federal Tax Service issues receipts along with documents for registration of individual entrepreneurs. Therefore, the entrepreneur does not need to make independent calculations.

2020

The individual entrepreneur contribution no longer depends on the minimum wage and is determined for 3 years in advance: 2018, 2019, 2020 - 32,385, 36,238, 40,874 rubles. (Federal Law of November 27, 2017 No. 335-FZ).

2019

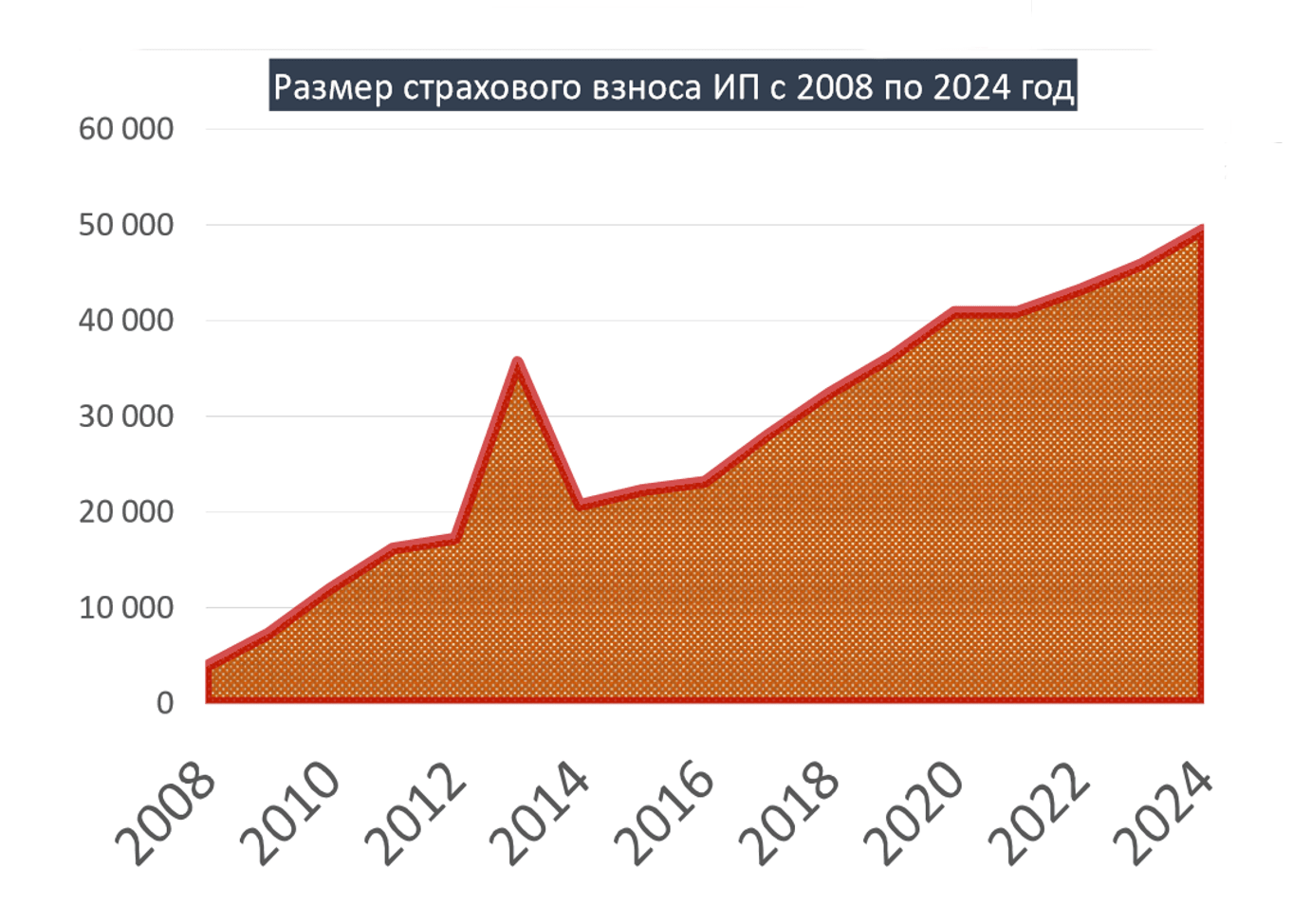

| 2008 RUB 3,864 | year 2009 RUB 7,274.4 | 2010 RUB 12,002.76 | 2011 RUB 16,159.56 | year 2012 RUB 17,208.25 |

year 2013 RUB 35,664.66 |

year 2014 RUB 20,727.53 (+1% of income) |

The website provides a full calculation of the individual entrepreneur’s fixed payment (insurance premium) for 2008-2020 to the Pension Fund.

Select the reporting year:

The three-year limitation period does not apply to the Pension Fund! For such contributions, the requirement for payment is made “no later than three months from the date of discovery of the arrears” (Article 70 of the Tax Code of the Russian Federation). Arrears can be identified for any period.

Dates

Select the reporting period:

You need to select a reporting period. If an individual entrepreneur was registered this year or is closed, you need an incomplete period. Also, by selecting an incomplete period, you can calculate the payment for the month:

The first day of registration of an individual entrepreneur is taken into account inclusively (Article 430, paragraph 3 of the Tax Code of the Russian Federation). Those. According to the law, if registration is, for example, on the 15th, then insurance premiums for individual entrepreneurs must be calculated starting from the 15th inclusive.

Fees for individual entrepreneurs have always been paid and continue to be paid in kopecks (Article 431, clause 5 of the Tax Code of the Russian Federation).

Result..Total you need to pay:

You can also calculate individual entrepreneur contributions and generate receipts/payments.

Reducing individual entrepreneur taxes on contributions

| Tax regime | Entrepreneurs working without hired staff | Entrepreneurs working with hired personnel | Base |

|---|---|---|---|

| USN (object of taxation “income”) | The single tax can be reduced by the entire amount of insurance premiums paid in a fixed amount | The single tax can be reduced by no more than 50 percent. Contributions paid by the entrepreneur for hired employees and for his own insurance are accepted for deduction. | subp. 1 clause 3.1 art. 346.21 Tax Code of the Russian Federation |

| Payment for the year can be used: for 1 quarter - no more than 1/4, for half a year - no more than 1/2, for 9 months - no more than 3/4 of the annual amount of contributions, for a year - the entire amount of insurance premiums of an individual entrepreneur. See simplified tax system calculator + declaration Many people find it difficult to calculate the simplified tax system together with the Pension Fund deduction and divide it by quarter. Use this automated simplification form in Excel (xls). The form is already ready for 2017 with an additional insurance premium for individual entrepreneurs. |

|||

| USN (object of taxation “income minus expenses”) | You can reduce your income by the entire amount of insurance premiums paid | clause 4 art. 346.21 et sub. 7 clause 1 art. 346.16 Tax Code of the Russian Federation | |

| UTII | The single tax can be reduced by the entire amount of insurance premiums paid in a fixed amount | You can reduce UTII by no more than 50 percent. Contributions paid by the entrepreneur for hired employees, benefits and for his own insurance are accepted for deduction (from the age of 13 to 17, you could not reduce your contributions for employees) | subp. 1 item 2 art. 346.32 Tax Code of the Russian Federation |

| Patent | The cost of the patent does not decrease | Art. 346.48 and 346.50 Tax Code of the Russian Federation | |

| BASIC | Individual entrepreneurs on OSNO have the right to include a fixed payment in personal income tax expenses | NK Art. 221 | |

2018, 2019 and 2020

In 2018, RUB 32,385 (+15.7%)

In 2019 RUB 36,238 (+11.9%)

In 2020 RUB 40,874 (+12.8%)

The amount of insurance premiums is now directly stated in the tax code. And even 3 years in advance - for 2018-2020.

Article 430 of the Tax Code of the Russian Federation (as amended by Federal Law dated November 27, 2017 N 335-FZ):

a) paragraph 1 should be stated as follows:

"1. The payers specified in subparagraph 2 of paragraph 1 of Article 419 of this Code pay:

1) insurance contributions for compulsory pension insurance in the amount determined in the following order, unless otherwise provided by this article:

if the payer’s income for the billing period does not exceed 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period of 2018, 29,354 rubles for the billing period of 2019, 32,448 rubles for the billing period of 2020;

if the payer’s income for the billing period exceeds 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period of 2018 (29,354 rubles for the billing period of 2019, 32,448 rubles for the billing period of 2020) plus 1.0 percent of the payer’s income exceeding 300,000 rubles for the billing period.

In this case, the amount of insurance contributions for compulsory pension insurance for the billing period cannot be more than eight times the fixed amount of insurance contributions for compulsory pension insurance established by paragraph two of this subclause;

2) insurance premiums for compulsory medical insurance in a fixed amount of 5,840 rubles for the billing period of 2018, 6,884 rubles for the billing period of 2019 and 8,426 rubles for the billing period of 2020.";

Additional percentage

If you are on OSNO or simplified tax system, then you pay an additional percentage on your income. If you are on PSN or UTII, be sure to read the table below (then it is not paid from real income).

In 2020, the contribution will be: 40,874 rubles (pay by December 25). With an income of 300,000 rubles (cumulative total for the year), you will need to pay additionally plus 1% (pay before July 1) of the difference (total income - 300,000 rubles), but no more than based on 8 minimum wages (for the Pension Fund of Russia ). Those. the maximum payment will be: 8 * 32,448 = 259,584 rubles (in 2020).

In 2019, the contribution will be: 36,238 rubles (pay before December 25). With an income of 300,000 rubles (cumulative total for the year), you will need to pay additionally plus 1% (pay before July 1) of the difference (total income - 300,000 rubles), but no more than based on 8 minimum wages (for the Pension Fund of Russia ). Those. the maximum payment will be: 8 * 29,354 = 234,832 rubles (in 2019).

In 2018, the contribution will be: 32,385 rubles (pay by December 25). With an income of 300,000 rubles (cumulative total for the year), you will need to pay additionally plus 1% (pay before July 1) of the difference (total income - 300,000 rubles), but no more than based on 8 minimum wages (for the Pension Fund of Russia ). Those. the maximum payment will be: 8 * 26,545 = 212,360 rubles (in 2018).

In 2017, the contribution will be: 7,500 rubles * 12 * (26% (PFR) + 5.1% (MHIF)) = 27,990 rubles (pay before December 25). With an income of 300,000 rubles (cumulative total for the year), you will need to pay additionally plus 1% (pay before July 1) of the difference (total income - 300,000 rubles), but no more than based on 8 minimum wages (for the Pension Fund of Russia ). Those. the maximum payment will be: 8 * minimum wage * 12 * 26% = 187,200 rubles (in 2017).

Those who were late with reporting (to the tax office) also had to pay contributions to the Pension Fund based on 8 minimum wages (until 2017). Since 2017, this norm has been abolished (letter of the Federal Tax Service of Russia dated September 13, 2017 No. BS-4-11/18282@). And in July 2017, they even announced an “amnesty” for those who were late with reporting for 2014-2016, the maximum fine will be removed (see statement) (PFR letter dated July 10, 2017 No. NP-30-26/9994).

For an additional 1% in the Pension Fund (it goes only to the insurance part, the FFOMS does not need it): there are 2 options under the simplified tax system “Income”

1) Transfer 1% before December 31, 2018 and reduce the simplified tax system for 2018 (See Letter of the Ministry of Finance dated February 21, 2014 N 03-11-11/7511)

2) Transfer 1% in the period from January 1 to July 1, 2019 and reduce the simplified tax system for 2019 (See Letter of the Ministry of Finance dated January 23, 2017 No. 03-11-11/3029)

You don’t have to read the dispute below, because... The Ministry of Finance issued Letter of the Ministry of Finance of Russia No. 03-11-09/71357 dated December 7, 2015, in which it recalled the letter of the Ministry of Finance of Russia dated October 6, 2015 No. 03-11-09/57011. And now at all levels they believe that it is POSSIBLE to reduce the simplified tax system by this 1%.

Shocking news: the letter of the Ministry of Finance of Russia dated October 6, 2015 No. 03-11-09/57011 states that this 1% is not a fixed contribution at all and the simplified tax system for individual entrepreneurs has no right to reduce the tax on it. Let me remind you that the position of the Ministry of Finance (especially such a windy one) is not a legislative act. Let's look at future judicial practices. There is also a letter from the Federal Tax Service of Russia dated January 16, 2015 No. GD-4-3/330, which expresses the position that this 1% can be reduced.

In 212-FZ article 14 clause 1. It is directly stated that this 1% is a contribution in a fixed amount, the position of the Ministry of Finance, expressed in the letter of the Ministry of Finance of Russia dated October 6, 2015 No. 03-11-09/57011, contradicts this law:

1. Payers of insurance contributions specified in paragraph 2 of part 1 of Article 5 of this Federal Law pay the corresponding insurance contributions to the Pension Fund Russian Federation and the Federal Compulsory Medical Insurance Fund in fixed amounts determined in accordance with parts 1.1 and 1.2 of this article.

1.1. The amount of the insurance contribution for compulsory pension insurance is determined in the following order, unless otherwise provided by this article:

1) if the amount of income of the payer of insurance premiums for the billing period does not exceed 300,000 rubles - in a fixed amount, determined as the product minimum size wages established by federal law at the beginning of the financial year for which insurance premiums are paid, and the tariff of insurance contributions to the Pension Fund of the Russian Federation, established by paragraph 1 of part 2 of Article 12 of this Federal Law, increased by 12 times;

2) if the income of the payer of insurance premiums for the billing period exceeds 300,000 rubles - in a fixed amount, defined as the product of the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the tariff of insurance premiums to the Pension Fund of the Russian Federation, established by paragraph 1 of part 2 of Article 12 of this Federal Law, increased by 12 times, plus 1.0 percent of the amount of income of the payer of insurance contributions exceeding 300,000 rubles for the billing period. In this case, the amount of insurance premiums cannot be more than the amount determined as the product of eight times the minimum wage established by federal law at the beginning of the financial year for which insurance premiums are paid, and the rate of insurance contributions to the Pension Fund of the Russian Federation established by paragraph 1 of part 2 of the article 12 of this Federal Law, increased by 12 times.

I also draw your attention to:

Article 75. Penalty

8. Penalties are not charged on the amount of arrears that a taxpayer (fee payer, tax agent) has incurred as a result of his compliance with written explanations on the procedure for calculating, paying a tax (fee) or on other issues of application of the legislation on taxes and fees given to him or an unspecified circle of persons financial, tax or other authorized government body (authorized official of this body) within its competence (these circumstances are established in the presence of a corresponding document of this body, in the meaning and content relating to the tax (reporting) periods for which the arrears arose, regardless of the date of publication of such a document), and (or) as a result of the execution taxpayer (fee payer, tax agent) motivated opinion tax authority sent to him during tax monitoring.

Article 111. Circumstances excluding a person’s guilt in committing a tax offense

3) execution by the taxpayer (fee payer, tax agent) of written explanations on the procedure for calculating, paying a tax (fee) or on other issues of applying the legislation on taxes and fees given to him or an indefinite number of persons by a financial, tax or other authorized government body (authorized official of this body) within his competence (these circumstances are established in the presence of a corresponding document of this body, in the meaning and content related to the tax periods in which the tax offense was committed, regardless of the date of publication of such a document), and (or) the taxpayer’s fulfillment ( payer of the fee, tax agent) a reasoned opinion of the tax authority sent to him during tax monitoring.

You can refer to three such clarifications. They are taller.

With UTII, this 1% can be paid until the end of the quarter and then reduced UTII.

Table by which the additional 1% is calculated (under different tax regimes)|

Tax regime |

Where is the income registered? |

||

|---|---|---|---|

|

Reason: Part 8 of Article 14 of the Federal Law of July 24, 2009 No. 212-FZ as amended by the Federal Law of July 23, 2013 No. 237-FZ. If you use two or three systems (for example, simplified tax system + UTII), then the income from these systems must be taken in total for all systems. |

|||

|

(income from business activities) |

Income subject to personal income tax. Calculated in accordance with Article 227 of the Tax Code of the Russian Federation However, costs can be calculated based on this. Also, when calculating income for calculating 1%, you can take into account professional tax deductions (Letter of the Ministry of Finance of Russia dated May 26, 2017 N 03-15-05/32399) |

Declaration 3-NDFL; clause 3.1. Sheet B. In this case, expenses are not taken into account. |

|

|

Income subject to the Single Tax. Calculated in accordance with Article 346.15 of the Tax Code of the Russian Federation The latest letters indicate that 1% of additional contributions should be calculated only from income (letter of the Ministry of Finance dated 02.12.2018 No. 03-15-07/8369) (letter of the Federal Tax Service dated 02.21.2018 No. GD-4-11/3541) (letter Federal Tax Service dated January 21, 2019 No. BS-4-11/799. |

Many people find it difficult to calculate the simplified tax system along with the Pension Fund deduction. Use this automated simplification form in Excel. The form contains all years, taking into account additional individual entrepreneur contributions. For more early years there too - right there. |

||

|

Patent system |

Potential income. Calculated in accordance with Article 346.47 and 346.51 of the Tax Code of the Russian Federation |

Income from which the cost of the patent is calculated. In this case, expenses are not taken into account. |

|

|

Imputed income. Calculated in accordance with Article 346.29 of the Tax Code of the Russian Federation |

Result of column 4 of the Book of Income and Expenses. In this case, expenses are not taken into account. |

||

If the individual entrepreneur was closed and opened in the same year?

Then the periods are considered separately, as unrelated. Those. for one period a deduction of 300 thousand rubles is given. and for the second period of work, individual entrepreneurs are also given a deduction of 300 tr (Letter of the Ministry of Finance dated 02/06/2018 No. 03-15-07/6781). However, we do not specifically recommend using this loophole. The maximum you will receive is 3000 rubles and minus all duties and then 1500 rubles. You will spend ten times more time and nerves.

Example income is 1,000,000 rubles. 27,990 rubles: pay before December 25, 2017 (this is for any income). Plus 1% of the difference (1,000,000 - 300,000) = 7,000 rubles additionally paid before July 1, 2018 for the insurance part of the Pension Fund.

Constitutional Court ruling

Its essence is that individual entrepreneurs on OSNO can take into account expenses when calculating an additional contribution (1% percentage of income) to the Pension Fund. Before this, individual entrepreneurs on any system calculated an additional contribution from their income. The decision applies only to individual entrepreneurs on OSNO, however, individual entrepreneurs in other systems can also refer to it to prove their case in court.

Reporting

The pension payment period is from January 1 to December 31 of the reporting year. The deadline for paying an additional 1% is from January 1 of the current year to April 1 (from 2018 (for 2017) - until July 1) of the next year.

You can pay the fee in installments. For example, with UTII you need (with the simplified tax system it is advisable) to pay quarterly in order to deduct it from the tax.

If an individual entrepreneur fails to pay a payment to the Pension Fund on time, a penalty in the amount of 1/300 multiplied by the refinancing rate per day. Penalty calculator

Since 2012, individual entrepreneurs have not submitted reports to the Pension Fund (except for heads of peasant farms). For 2010 there was RSV-2, previously ADV-11.

Payment

KBK

Why is the BCC of a regular Pension Fund for exceeding 300 tr. same as 2017? We have been paying for one BCC since 2017 - they are the same (letter of the Ministry of Finance dated 04/07/2017 No. 02-05-10/21007).

KBC are correct here.

On February 22, 2018, a new BCC was introduced for payments over 1% of insurance premiums - 182 1 02 02140 06 1210 160 (order dated December 27, 2017 No. 255n). However, then it was canceled (order dated February 28, 2018 No. 35n). For the additional percentage, the BCC does not change.

| Payment type | Until 2017 (for any year - 2016, 2015, etc.) | After 2017 (for any year - 2017, 2018, 2019, etc.) |

|---|---|---|

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation in a fixed amount (based on the minimum wage) | 182 1 02 02140 06 1100 160 | 182 1 02 02140 06 1110 160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles. | 182 1 02 02140 06 1200 160 | 182 1 02 02140 06 1110 160 |

| Insurance premiums for medical insurance for individual entrepreneurs for themselves in the Federal Compulsory Compulsory Medical Insurance Fund in a fixed amount (based on the minimum wage) | 182 1 02 02103 08 1011 160 | 182 1 02 02103 08 1013 160 |

How long should payments be kept? Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Ways

There are four ways:

Video

I invite you to watch my short video about the insurance premium of individual entrepreneurs.

Right not to pay

This right only exists if you have zero income for the year, so there is almost no point in it.

Since 2017, the right not to pay contributions has been retained. However, it is regulated by other laws.

Since 2013, you can avoid paying fixed contributions for the following periods:

However, if no business activity was carried out during the above periods (Parts 6-7, Article 14 of Law 212-FZ), it is necessary to submit documents confirming the absence of activity during the specified periods. Those. all the conditions above must be present, and the income must also be zero. In this case, it is easier to close the individual entrepreneur.

What if I am employed?

You are required to pay individual entrepreneur contributions to the Pension Fund of the Russian Federation even if your employer pays contributions for you under an employment or civil law contract. This issue is not controversial from a legislative point of view and the chances of challenging it in court are zero. See Letter of the Ministry of Finance of Russia dated February 19, 2019 No. 03-15-05/10358.

It makes no sense to pay voluntary contributions to the Social Insurance Fund for individual entrepreneurs if you are employed.

How to calculate taxes and insurance premiums is stipulated in the Tax Code. Chapter 34 explains the procedure for deducing contribution obligations for compulsory types of insurance individuals. The contribution for injuries does not fall within the sphere of influence of the Tax Code of the Russian Federation; it remains under the jurisdiction of the Social Insurance Fund. Payers of contributions are:

- Employers represented by companies or individual entrepreneurs. They calculate liabilities to the budget from the earnings of hired personnel, taking into account the upper limits on contributions. To compare income amounts with limits, the total salary accrued to a person since the beginning of the current year is taken.

- Individual entrepreneurs who pay contributions for themselves. For them in 2018, fixed tariffs are provided, which are enshrined in Art. 430 Tax Code of the Russian Federation.

How to calculate insurance premiums for individual entrepreneurs

In 2018, insurance premiums are not linked to the minimum wage. When calculating pension obligations, two tariffs are applied:

- if the entrepreneur’s income at the end of the year did not exceed the limit of 300,000 rubles, then only a fixed rate of 26,545 rubles must be paid. (next year the value of this indicator will be increased);

- if the total income of an individual entrepreneur turns out to be more than the legally established limit at the end of the annual interval, you must pay a fixed amount and an additional 1% of the excess amount.

There is a maximum limit for pension contributions - it is 8 fixed amounts of payments valid in the reporting period. That is, in 2018, an entrepreneur will pay no more than 212,360 rubles for pension insurance. (8 x 26,545). For medical insurance, the tariff is 5840 rubles.

How to calculate insurance premiums if a private merchant did not work for the whole year - the answer is given in paragraphs 3-5 of Art. 430 Tax Code of the Russian Federation. Fixed payments for an incomplete billing period are calculated in proportion to the number of months during which the individual entrepreneur actually worked. Calendar months are taken as the basis for the calculation, counting starts from the month in which the entrepreneur registered the start of business activities.

In situations where the billing period was incomplete due to the entrepreneur’s cessation of commercial activity, when calculating the duration of time worked, months prior to the calendar month in which the record of termination of activity appeared in the Unified State Register of Individual Entrepreneurs were taken into account. If an individual entrepreneur has not been registered since the beginning of the year and there is an incomplete month in the billing period, the amount of contributions for a partially worked monthly interval is determined in proportion to the number of days worked in calendar terms. The calculation should take into account the dates when the entrepreneur registered with the Federal Tax Service and when he officially ceased operations.

Examples of calculation of contributions if an individual entrepreneur is not registered from the beginning of the year

Let’s say an entrepreneur registered with the Federal Tax Service on March 1, 2018 and worked until the end of the year. The calculation interval contains only full months. The fixed payment of contributions must be withdrawn for 10 months of 2018:

- For pension insurance. First, the contribution amount per calendar month is calculated - 2212.08 rubles. (26,545 / 12). At the next stage, the final value of the contribution for time worked in 2018 is calculated - RUB 22,120.80. (2212.08 * 10).

- For health insurance. The monthly contribution is 486.67 rubles. (5840 / 12), for partially worked 2018 you need to pay 4866.70 rubles. (486.67 * 10).

How to calculate taxes and contributions if there is an incomplete calendar month in the billing period? For example, an individual entrepreneur registered in March, but not on the 1st, but on the 12th. In this situation, there will be 9 full months, and 1 incomplete month (March). For March, you need to do the calculation by day. The final calculations will be as follows:

- For pension insurance. For 9 months you need to pay 19,908.75 rubles. (26,545 / 12 x 9). For March, the amount to be paid is 1427.15 rubles. (26,545 / 12 / 31 x (31 – 11)). The final amount of pension contributions is RUB 21,335.90. (1427.15 + 19,908.75).

- For health insurance. For 9 months, 4,380 rubles are payable. (5840 / 12 x 9). March contribution obligations amount to RUB 313.98. (5480 / 12 / 31 x (31-11)). The total amount is 4693.98 rubles. (4380 + 313.98).