Payments upon registration for pregnancy. How to apply for benefits in connection with registration in the early stages of pregnancy

During pregnancy, a woman should be observed in a consultation or other medical facility. In this case, she not only does not have to worry about bearing a child, but also has the right to count on some help from the state.

If a pregnant woman consults a gynecologist before 12 weeks, she can receive the benefit established in Russia. The procedure for its provision is reflected in Federal Law No. 81-FZ, issued on May 19, 1995. On its basis, a one-time benefit is paid for early registration.

To receive payment from the employer, a woman draws up an application for benefits in connection with registration with early dates pregnancy. After the document is accepted, an order for payment is issued.

What is this payment and who is entitled to it?

Cash benefits are provided to women who visited a doctor before the end of the first trimester of pregnancy. Gynecologists define this period as 12 weeks. The application is considered early and makes it possible from the very beginning of pregnancy to monitor the dynamics of fetal development and exclude possible pathologies.

Subject to of this rule in accordance with Russian Federation Law No. 81-FZ, a pregnant woman is entitled to a certain payment. Also, the right to receive it is supported by the Order of the Ministry of Health and Social Development of the Russian Federation (No. 1012n).

The payment is considered additional and is assigned at the time of transfer of funds according to the certificate of incapacity for work. It is issued at 30 weeks to an expectant mother who is going on maternity leave.

The following rest is provided:

- permanently officially employed women;

- expectant mothers who were laid off due to the liquidation of a person registered as an individual entrepreneur;

- pregnant students studying full-time on a budgetary and commercial basis;

- contract employees in the Ministry of Defense, Ministry of Internal Affairs, Ministry of Emergency Situations, FSSP, TS.

If the woman is considered unemployed, receive payments from the employer for this type She is not entitled to leave.

A special category consists of people running their own business. Individual entrepreneurs can count on benefits. But it is provided only with modern contributions to the Social Insurance Fund during the year preceding the date of maternity leave.

When do you need to register?

Many women do not know what is considered early pregnancy. Gynecologists and legislators have determined that this is any time before the end of the first trimester of pregnancy. The most late 12 obstetric weeks are considered.

The last day on which you can register to receive a payment is not regulated at the legislative level. However, clarifications are provided by the Social Insurance Fund, which transfers benefits.

When applying to the Social Insurance Fund, payment of funds is possible only before the immediate deadline of 12 weeks. Therefore, specialists only accept certificates reflecting registration up to 11 weeks and 6 days. If the deadline is missed, no payments will be made.

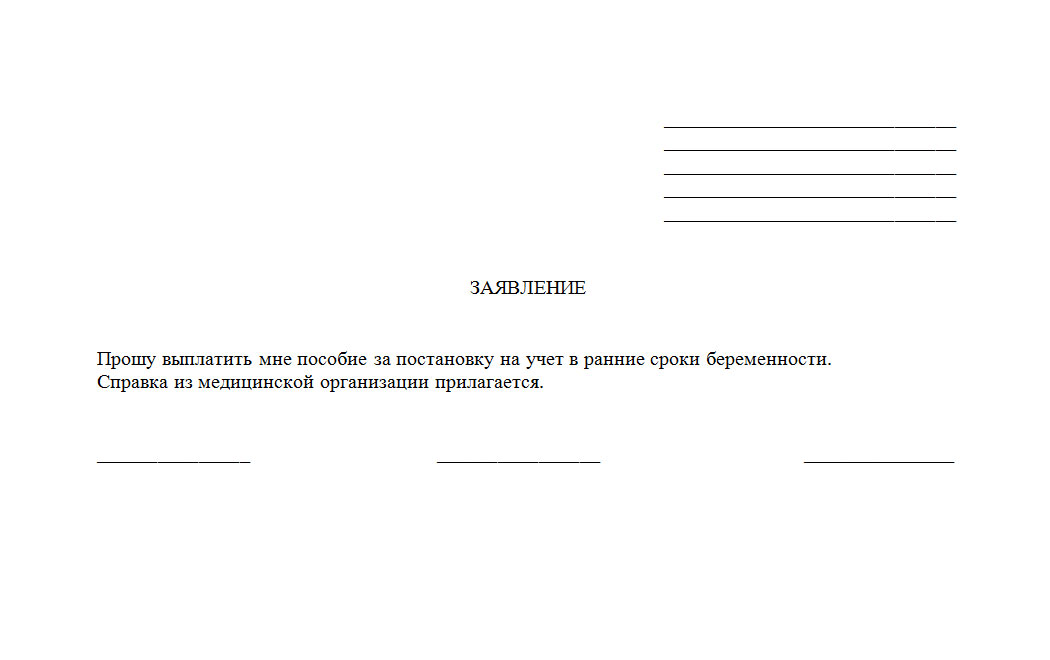

Application form for benefits in connection with registration in the early stages of pregnancy

Application form for benefits in connection with registration in the early stages of pregnancy How much should I expect?

The benefit to be paid is calculated at the state level. Initially, its size was 300 rubles. However, the amount increases every year. This is due to both indexation carried out on a federal scale and inflation. Additionally, at regional levels, coefficients are introduced that can increase the amount paid.

The procedure for calculating benefits is provided for by Federal Law No. 81 and Order No. 102n. The latter discusses paragraphs 20, 79. For example, for 2015, a woman could receive about 543 rubles if she lived in a subject where the regional coefficient is not applied.

A similar amount was provided for pregnant women who registered before 02/01/2016. However, after this, benefits were indexed. As a result, the payment amount increased. Therefore, the new amount is 581 rubles and 73 kopecks.

The benefit is calculated immediately at the time of going on leave before giving birth. For example, a woman registered on December 25, 2015. At the same time, she is supposed to go on maternity leave on May 15, 2016. She will receive not 543 rubles (as was expected in 2015), but 581 rubles, since 30 weeks fall in 2016.

In some cases, employees receive non-indexed payments. However, after the procedure is carried out at the state level, they are entitled to additional payment of the missing amount after recalculation.

Submitting an application for benefits in connection with registration in the early stages of pregnancy and other documents

To assign and pay benefits to a woman, you will need to provide the employer with the necessary documents. The main one among them is a certificate confirming registration before the onset of the second trimester (up to 12 weeks). It is issued by the gynecologist who is caring for the pregnant woman, having previously signed it with the head of the department.

It is allowed to provide a certificate along with the rest of the papers that are required to calculate benefits when going on maternity leave. In this case, payments are made in a lump sum.

The option of later delivery of the certificate is also possible. Then the transfer of funds is made within 10 days after the employer registers the document.

It is allowed to provide documents within six months after the birth or adoption of the baby.

Payments made from the Social Insurance Fund will be calculated and transferred based on:

- a statement drawn up by an employee at her place of work;

- passport identifying the applicant;

- a certified extract from, confirming the last place of employment;

- a certificate certifying registration for pregnancy before the 12th week of pregnancy;

- a document issued by the employment center stating that the woman is recognized as unemployed;

- confirming the absence of transfer of benefits from a paper issued by the social protection service (if the application is made not at the place of registration, but at residence or stay).

It is worth remembering that photocopies will only be valid if you have original documents. The transfer can be made to the territorial branch of the Social Insurance Fund either personally by the applicant or by mail.

At their place of residence, women have the right to apply for benefits in three ways:

- to the Social Insurance Fund at the place of residence or stay;

- to the territorial Multifunctional Center(for residents of Moscow and St. Petersburg);

- through an online application (for residents of Moscow and St. Petersburg).

When transferring documents to the place of employment, the package of documents is changed by the employer himself.

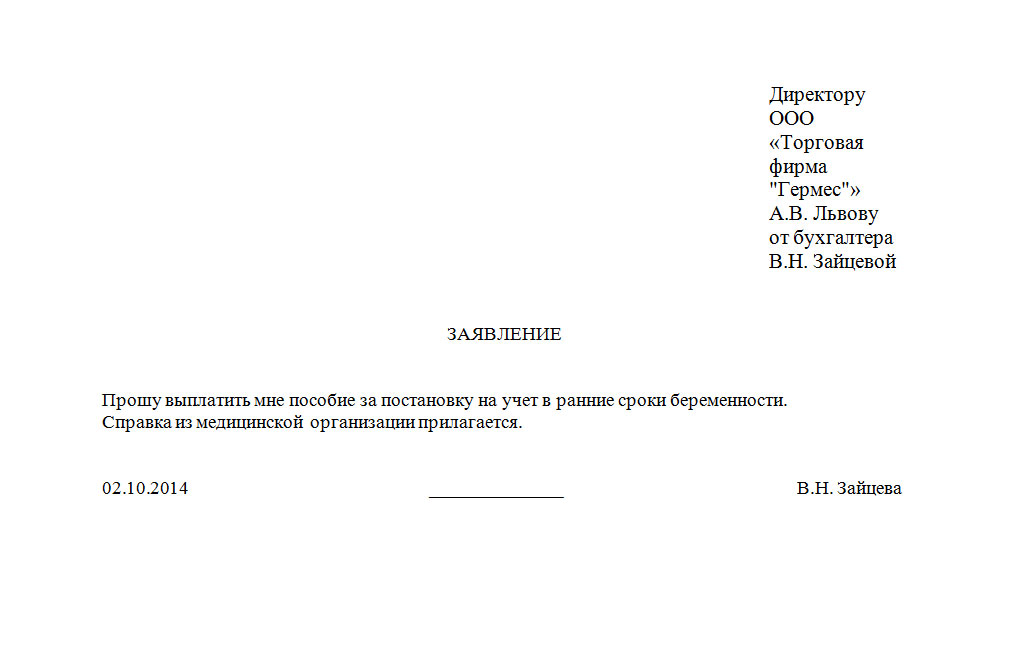

Most often they ask to include:

- application for benefits in connection with registration in the early stages of pregnancy;

- a certificate issued by a registered gynecologist stating that the woman has registered for pregnancy up to 12 weeks.

Benefits are paid within the time limits specified by law. The woman should expect the funds to be transferred within 10 days after submitting the full package of documents.

There are non-standard cases that require special attention. They relate to a change in the spouse’s place of work and the family moving to another locality. When maternity leave begins within a month after dismissal and the woman receives benefits at her last place of employment, it is additionally necessary to include in the package of documents a certificate of employment of the spouse and a marriage certificate.

If an illness occurs due to which work or residence in this region It is not possible, you need to have a conclusion from a medical institution confirming this fact.

If it is necessary to provide care for disabled people of the first group and sick relatives, it is important to provide a medical report and documentation confirming the relationship.

Payment order

An order for payment is drawn up by the employer when the woman provides him with a certificate of early registration and an application.

A sample document can be found on the Internet or use the option below:

LLC "Yugstroyinvest" Code 364

Form according to OKUD 8456018

according to OKPO 9545328

Date of preparation

№54-3 24.11.2016

for the payment of a one-time benefit to women registered with a medical institution in the early stages of pregnancy

Personnel Number

Konstantinova Diana Albertovna

sales department

top manager

When registering for early pregnancy management

I ORDER:

- Make a one-time payment of five hundred ninety-four rubles (594 rubles 00 kopecks) taking into account the regional coefficient.

Reason: provided registration certificate No. 3645 from City Clinic No. 24, issued on November 22, 2016, and an application from Diana Albertovna Konstantinova dated November 23, 2016.

General Director_________________ Korobov A.Yu.

The order for payment of benefits is drawn up arbitrarily. This is due to the fact that the law does not provide for a unified form of the document.

Despite this, it must reflect:

- last name, first name, patronymic, personnel number, structural unit and position of the employee;

- confirmation of the right to receive payment (application and certificate);

- benefit amount;

- other necessary information.

At the end of the document there must be a signature of the head of the organization. In addition, the employee’s familiarization is also confirmed by a date and signature.

Sample of filling out an application for benefits in connection with registration in the early stages of pregnancy

Sample of filling out an application for benefits in connection with registration in the early stages of pregnancy Appointment dates

A woman can apply to exercise her right to receive payment at the moment when a confirming certificate is issued. It can be provided either immediately after receipt or on any day within six months after the end of maternity leave (140 days).

The payment is made in a lump sum with the allowance before going on maternity leave. However, settlement with the employee is possible only if a certificate is provided. Therefore, it is important to simultaneously send a certificate of incapacity for work and a paper on early registration to the accounting department.

Some medical institutions do not comply with deadlines and issue documents later than sick leave. Then the benefit is accrued upon provision. Payments are due no later than 10 days after registration of the certificate.

If the enterprise was liquidated or the individual entrepreneur ceased his activities, then certificates are accepted in a similar way. But FSS payments are made until the 26th day of the month following the date of application.

Display in accounting

The funds allocated for early registration are transferred by the Social Insurance Fund. However, the payment is made directly to the employee by the employer. Therefore, they must be included in accounting.

Payments must be made to account 69. During work, accountants post money as D 69 K 70. When funds are issued to an employee, posting D70 K50 (51) is performed.

Taxation

According to the law, taxation does not apply to early registration benefits. He is not charged personal income tax, contributions to the Compulsory Medical Insurance Fund, Pension Fund, Social Insurance Fund, or insurance premiums.

Since the transfer of funds is made by the social insurance fund, the institution does not consider the payment as expenses (based on Article 252 of the Tax Code of the Russian Federation). When transferring benefits, the amount is not included in that used to determine the organization's income tax. Also other fees remain unchanged.

If special tax regimes are used, a similar rule applies. The benefit is not counted as expenses under the simplified taxation system and UTII.

The benefit is provided for all women who are studying full-time or working at the time of pregnancy. It is important that they register before the 12 week period.

Order on approval of the payslip for wages you can download.

One-time benefit for women registered in medical institutions in the early stages of pregnancy is assigned to working women in addition to maternity benefits, subject to their registration at the antenatal clinic before 12 weeks of pregnancy on the basis of Article 9 of Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children.”

This benefit is drawn up and issued by the employer at the expense of the Social Insurance Fund of the Russian Federation when the employee submits a certificate of registration in the first 12 weeks of pregnancy. The right to this benefit is available to women who are entitled to receive maternity benefits, which are usually paid at the same time.

If the certificate of registration from the antenatal clinic is submitted later, then in accordance with clause 24 of the Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children,” the specified benefit is paid on 10 - ten ten days after its submission, provided that the application for benefits followed no later than six months after the end of maternity leave.

Providing a working pregnant woman with even a small additional allowance is intended to encourage her to begin timely and optimal control of the course of her pregnancy, which, of course, is important both for the health of the woman herself and the development of the unborn child.

The size of the one-time benefit for women registered in medical institutions in the early stages of pregnancy is subject to annual indexation and from February 1, 2017 is equal to 613 rub. 14 kopecks(in 2016 - 581 rubles 73 kopecks, in 2015 - 543 rubles 67 kopecks, in 2014 - 515 rubles 33 kopecks, in 2013 - 490 rubles 79 kopecks).

A woman’s visit to an antenatal clinic in the early stages of pregnancy is also important for her from the point of view of participation in the national project “Health”, within the framework of which she is issued a birth certificate, which provides high-quality and qualified medical care during pregnancy, childbirth and the postpartum period, as well as clinical observation of a child in the first year of life. In addition, through the antenatal clinic, free medications are provided to pregnant women using funds from birth certificates.

It is also important for workers to find out in time about the labor benefits provided to pregnant women Labor Code RF. The complex of such benefits allows them to optimally combine labor activity with supervision in the antenatal clinic.

Pregnant women who are registered at the antenatal clinic in the early stages of pregnancy (up to 12 weeks), permanently residing (working) in the territory of the residence zone with the right to resettlement and exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, as well as living in those specified in paragraph 4 part one of article 1 of law 175-FZ in populated areas (clause 6 of part one of article 18 of law 1244-1, article 7 of law 175-FZ) is appointed additional one-time benefit in the amount of 146.87 rubles. taking into account indexation from February 1, 2017 by a factor of 1.054 (in 2016 - 139.35 rubles, in 2015 - 130.23 rubles, in 2014 - 123.44 rubles).

News on the topic

Other federal child benefits and child care payments

- Monthly allowance for child care up to 1.5 years

Assigned and paid to one of the parents actually caring for the child until he reaches the age of 1.5 years. All citizens have the right to receive this benefit: both working and non-working. Those who work - at their place of work in the amount of 40% of average earnings, those who do not work - in the bodies of the USZN in a fixed amount.

- Monthly allowance for the child of a soldier undergoing military service upon conscription

It is assigned and paid to the child’s mother, guardian or other relative who is actually caring for the child from the day of his birth, but not earlier than the day the child’s father begins military service on conscription, and ends when the child reaches the age of 3 years, but no later than the day of completion father's military service.

Assigned and paid upon adoption of a disabled child, a child over seven years old, as well as children who are brothers and (or) sisters at the expense of federal budget funds provided in the form of subventions to the budgets of constituent entities Russian Federation. When adopting two or more children, a lump sum benefit is paid for each child.

All benefits and payments

Popular answers to questions about child benefits

In accordance with Part 2 of Article 14 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, the average earnings on the basis of which maternity benefits are calculated include all types payments and other remunerations in favor of the employee, which are included in the base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation...